Made-To-Order for Your Restaurant

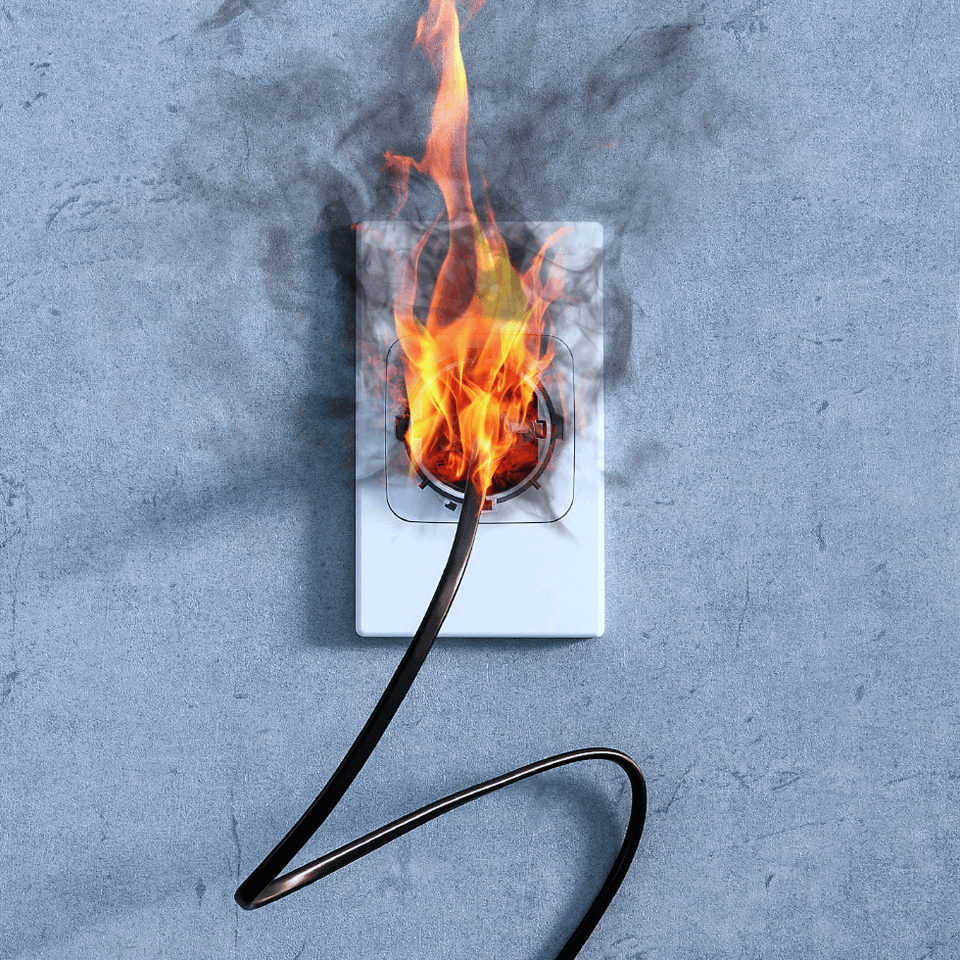

We work directly with insurance companies to offer you specialized coverage for your restaurant insurance. From your commercial property to your general liability and everything in between, we'll make sure you have what you need to operate your restaurant business.